Investing can feel like a maze of complex terms and intimidating numbers, but it doesn’t have to be that way. For young investors looking to build a solid financial future, just getting started is the most important part. Young investors have one of the most powerful forces in the world on their side: time. With the time that young investors have, they can take advantage of one of the other most powerful forces in the world: compounding interest. In this post, we’ll break down essential investing concepts, discuss why starting early matters, and outline actionable steps to get you on the path to financial freedom.

Why Invest?

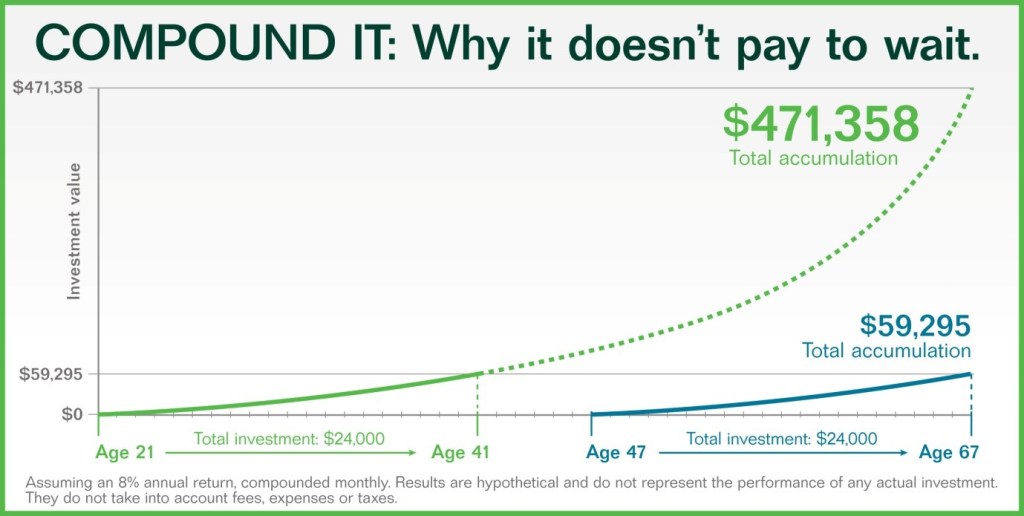

Investing isn’t just about making money—it’s about letting your hard-earned money work for you. When you invest, you’re buying a piece of a business, a bond, or an index that represents many companies. Over time, these investments can grow through the magic of compound interest, turning small contributions into significant wealth. For young investors, the advantage is time. Even modest investments made consistently can multiply over decades.

Key Investment Vehicles

- Stocks:

Buying shares in companies means you own a part of that company. Stocks can offer high returns but come with higher volatility. - Bonds:

Bonds are loans you give to governments or companies in exchange for interest payments. They’re typically less risky than stocks. - Mutual Funds & Index Funds:

Mutual funds pool money from many investors to buy a diversified portfolio of stocks or bonds. Index funds, which track a market index (like the S&P 500), are passively managed and often have lower fees. - Exchange-Traded Funds (ETFs):

ETFs work similarly to mutual funds but trade like stocks on an exchange. They offer diversification and flexibility.

Getting Started: Steps to Build Your Portfolio

- Educate Yourself:

Start by reading books, following trusted financial blogs, and taking beginner-friendly courses. Knowledge builds confidence. - Set Clear Goals:

Define what you’re investing for—a down payment on a home, retirement, or a future business venture. Your goals will guide your risk tolerance and investment choices. - Choose a Brokerage:

Look for platforms with low fees, fractional share options, and user-friendly interfaces. Many brokers today cater specifically to new investors. - Start Small and Automate:

Even if you can only invest a little at first, consistency is key. Automate your investments with a recurring deposit, so you’re building wealth without the stress of timing the market.

Understanding Risk and Reward

Every investment carries risk. However, risk can be managed with diversification—spreading your money across different assets so that no single loss devastates your portfolio. Balancing higher-risk investments (like stocks) with more stable options (like bonds) is essential for a long-term strategy.

The Role of Emotions in Investing

Investing isn’t purely mathematical—it’s emotional too. Many new investors fall prey to market panic during downturns or overexcitement during booms. Developing a disciplined approach and sticking to your plan can help you avoid impulsive decisions. Remember, markets go up and down; the key is to remain focused on your long-term goals.

Learning from Mistakes

Every investor makes mistakes, and that’s okay. What’s important is learning from them. Track your decisions, analyze what worked and what didn’t, and adjust your strategy over time. Consider each setback a stepping stone to smarter investing.

Tips for Staying on Track

- Keep It Simple:

As a beginner, avoid overly complex strategies. Start with index funds or ETFs that offer broad market exposure. - Regular Reviews:

Periodically review your portfolio. This helps ensure you’re on track to meet your goals and lets you rebalance if one area grows disproportionately. - Stay Informed:

While you shouldn’t obsess over daily market fluctuations, staying updated on economic trends and company news can help you make informed decisions.

Real-Life Examples

Imagine you start investing $100 a month at age 25. With a modest annual return of 7%, by the time you’re 65, you could have over $250,000—even without increasing your monthly contributions. This scenario demonstrates the immense power of starting early and remaining consistent. Assuming the same rate of return and time frame, each dollar that you own at age 25 is worth $15 at age 65, if invested properly. That’s something to think about.

Final Thoughts

Investing is a journey that begins with small, informed steps. For young investors, the most powerful tool is time. By educating yourself, setting clear goals, and building a diversified portfolio, you’re laying the groundwork for a future of financial independence. The world of investing is full of opportunities—your journey begins with that very first step.

Ready to start your investing journey? Comment below with your financial goals, and don’t forget to subscribe for more tips on building wealth from the ground up!

Leave a comment